Budgeting 102: 4 Ways To Track Your Spending

In my previous Budgeting 101: How To Start Bossing Your Money Around post, I detailed setting up a budget and included free printables. If you don’t have a budget going, consider taking a look at that post before jumping head first into this one.

If you’re reading this post it means that you have started bossing your money around and telling it what to do! That is great! Now the question is, how do you keep track of what you spend out of each category you set up on your budget worksheet? How do you know that you are staying within your budget? There are many ways to track and I’m going to outline 4 ways here. If any of these work for you, great! If not, develop the system that works best for you in keeping tabs on what you are spending out of your categories each month.

1. Classic System- Physical Cash Envelopes

- If the thought of tracking an expense electronically makes you want to throw in the towel, don’t let it.

- Setting up a simple cash based envelope system can really help keep your spending in check without causing you to have to be on top of every single transaction you make.

- We did this system early on when we were learning how to budget. 3 years later we have gone a more techie route because we have mastered bossing our cash around.

- This is my blog post about setting up your own envelope system with step by step instructions from creating your envelopes to going to the bank.

2. The Techie System- Using A Website/App To Track

- The newest Free app and website from Dave Ramsey is really intuitive and easy to use called EveryDollar.com! I highly recommend checking that out.

- My husband created an account using the app/online tool called Clear Check Book.

- We like this because the app is synced up between our smart phones. That means that when we make an entry, the changes show up immediately and we can both see them. If my husband grabs lunch one day and spends $5 from the “Eat Out” category, I can always see the actual running balance (as long as he enters the transactions).

- It’s not a way to spy on each other’s spending habits, it’s just a way to make sure that we know how much money we have at all times so that we don’t overspend without knowing it.

- With most checkbook or budgeting apps, you can quickly and easily enter or delegate your transactions just about anywhere you are.

- Simply use the app to set up each of your categories from your budget worksheet or spreadsheet. Set each category up with the budgeted amount and each time you spend, enter the transaction so it deducts the amount you spent from your budget amount in that category.

- If done correctly, you should be able to quickly and easily see each categories running balance. This helps you stay on top of spending so that you can successfully spend money as you planned and avoid overspending.

3. The I don’t know what I’m doing HELP! system- If you are totally overwhelmed by the idea of doing this alone, Dave Ramsey has an online tool called the Budget Wizard that costs around $9.95 per month. The tool usually has a free trail period to see if you use it or need it and you can cancel at anytime. This helps you step by step figure out what you are spending from a trusted online financial adviser.

4. Spreadsheets-

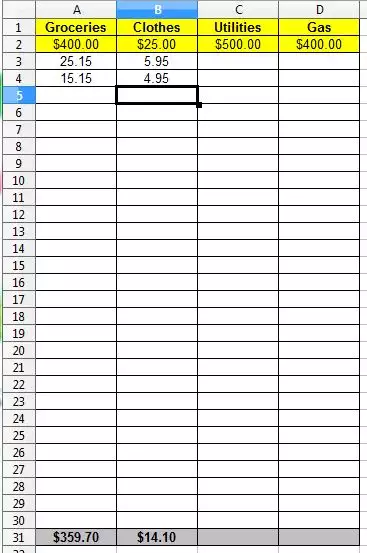

- If you have a simple knowledge of spreadsheets, consider setting one up to track your expenses.

- The sample I have created is very simple. You don’t need to enter where you spent money, just how much you spent.

- Create a spreadsheet named “April” or whatever month it is.

- Set up columns on the sheet with each category from your budget.

- Each day, or every other day, gather your receipts & check your automatic payments. Enter them under the column (line item) they belong to on the spreadsheet. (Example: Groceries in the grocery column, clothes in the clothes column.)

- To get the correct running balance of that category, you would need to click on A31 and enter this formula in the formula bar = A2-SUM(A3:A30). If done correctly, each time you enter a transaction the number in row 31 will reduce by that amount.

- To make this formula work for all your other columns just click on A31 and grab the little square at the bottom right of the cell and drag all the way to your last column. Stay in row 31. To grab the little box, your cursor will turn into a + sign and then you can start dragging. This automatically applies your formula to rest of the cells in that row so you don’t have to re-enter than formula for every single column.

- When the next month comes around simply make a copy of the sheet and name the sheet the new month. Delete all your transactions and update any changes to your budgeted amounts and you are ready to go again!

If you think you have this down, hop over to my next post “Budgeting Monthly Expenses: What’s Left Over” to see the 3rd part of the series and know what to do at the end of the month with whatever you have or don’t have!

Kim Anderson is the organized chaos loving author behind the Thrifty Little Mom Blog. She helps other people who thrive in organized chaos to stress less, remember more and feel in control of their time, money, and home. Kim is the author of: Live, Save, Spend, Repeat: The Life You Want with the Money You Have. She’s been featured on Time.com, Money.com, Good Housekeeping, Women’s Day, and more!