Budgeting Monthly Expenses-What’s Left Over

This post is the 3rd article in my series on Budgeting 101: How To Start Bossing Your Money Around. In this 3rd post I’m going to be helping you understand what to do at the end of the month with the money that’s left over. This is important when you are evaluating your spending and setting up the next month’s budget. The hope of this post to help you with budgeting monthly expenses more effectively.

A Note to New-Comers

If you are trying to budget monthly expenses and haven’t read Budgeting 101 & printed or used the free forms, it’s a good place to start. If you have a Budget, but need help tracking what you are spending check out Budgeting 102: How To Track Your Spending. If you’ve done all that and wonder what’s next, the last part of this wonderful monthly process is figuring out what you have left over!

Figuring Out What’s Left Over?

In some cases what’s left over is $0 and that’s okay. As long as you aren’t negative, you’ve don’t what you intended and told your money what to do! If you are negative, I’ve got tips in the steps below to handle it so don’t throw in the towel yet!

- Step 1: At the end of each month as you begin your new budget, you’ll want to go category by category that you have been tracking and see how much money is left over.

- Step 2: Compare our bank statements with your entries just to make sure you didn’t miss entering anything on your spreadsheet, app or hand written tracking.

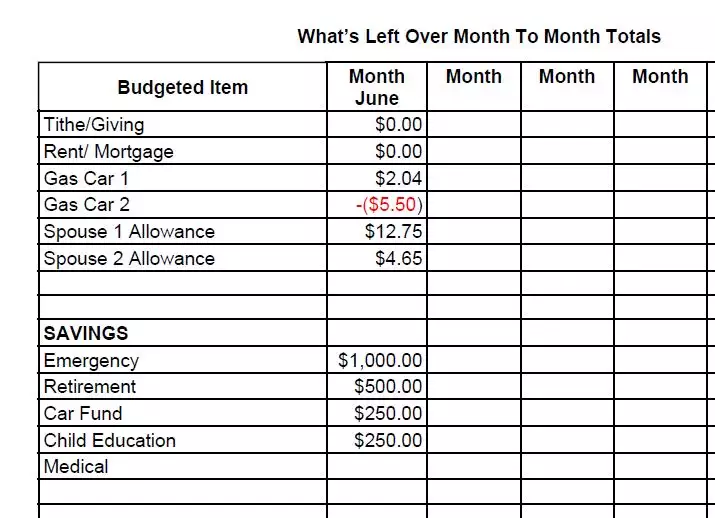

- Step 3: Feel free to print out this FREE 6 month Tracking Form that I made or add it as a column to your computerized spreadsheet.

- Step 4: Fill in the month at the top of your spreadsheet column and write down how much you had left over in every category whether it is a positive, zero or negative.

- If it’s a positive, way to go. That means you budgeted a little more than you needed as a cushion or you tried to save some cash.

- If it’s zero, good, you told your money what to do!

- If it’s a negative you have three options. 1- Budget more next month for that category. 2- Find left over money in another category or categories to cover the overage and deduct that amount from the other category’s total. 3- Stop spending more than you have told to go there.

- Step 5: As you move into budgeting for next month, use these numbers as a springboard for deciding what money goes where. Here are some things to consider as you decide.

Do you need it?

- Paycheck to Paycheck- Some families live paycheck to paycheck and any leftover money may need to go to a bill, emergency fund, loan payoff or back in the kitty to cover other real life expenses.

- A Little Leftover- For some families, it means just leaving that money parked in that category as a sort of virtual savings.

- More than Enough- For families with plenty of income, these kinds of leftovers might go toward paying off something like a mortgage, buying a new car or saving for a vacation. It’s more of a fun money type situation.

What do I do with it now?

- Paycheck to Paycheck- If you are living paycheck to paycheck I would simply total up what is left over and be prepared to spread it out the next month over your essential categories to be sure that you have enough. If this is you, your “Left Over Budget” categories will all return to zero and your money will be re-distributed in your new months budget with all the money from your next paycheck for life’s essentials to be sure your family can eat, has shelter and your utilities stay on.

- A Little Leftover- When you aren’t living paycheck to paycheck and you have a solid, steady income you can look over your “Left Over Budget” sheet and use each line item as a little pretend savings account for that category. For example, if you have $10 left in groceries in June, you can add it to your budget for the next month (zero out that line) and giving you extra money in groceries. Another option is simply pretending it’s not there and budget a normal amount out of your next paycheck for the next month so that your grocery budget stays the same and you have $10 building in your groceries “savings” until July. If in July you have $5 left over, your new total will be $15 in your grocery “Left Over Budget” for August. You add your left over August money to the $15 and keep building it month by month. On the other hand, if you haven’t built an emergency fund of 3-6 months of living expenses, consider moving all your left over money in each item to your “emergency fund” line and watch it grow.

- More than Enough- If you find that you have more than enough left over each month you can make each line a pretend savings account or you can start moving that money straight onto a mortgage payment or other loan payment. If you are debt free, you might consider adding the extra money left over in your columns straight into a “Luxury” line item to help out with a family vacation or other thing you’ve been dreaming up.

Step 6: Moving Forward Month By Month

- Depending on the various scenarios I’ve outlined above your month to month totals on these lines will vary.

- Based on your own personal situation and how you decide to boss your money around, these left over totals will be reallocated, slowly grow or be moved around. It’s totally up to you.

- If you let your line item left overs grow, add last months left overs to the new months leftovers in your columns. This way you always know what is in your spreadsheet “savings”. Example: My husband and I budget $20 for our dog from month to month and rarely use all the money. As we let the dog’s money grow, we know that based on what our latest columns says that we have $60 accumulated from month to month in her account. When her vet visit comes around in April we can plan to use that “savings” toward her vaccinations and annual tests rather than budgeting the total cost of her vet visit out of this month’s paychecks.

- It’s important that you track and write down what is leftover, zeroed out or overspent from month to month. This is how you stay in control of your money situation.

- No matter your income situation, a budget can work and help you get on the road to financial peace of mind. When you tell your money what to do, you know exactly where it goes and what it does and are never left wondering if you can make it.

If you have any questions or have any budgeting monthly expenses tips yourself, please feel free to share them in the comments section below! If you have gone through this final step you have officially completed a budget for a whole month! Just keep telling your money what to do, tracking your spending and managing the left overs and you are on your way to experiencing peace of mind in your financial life!

Kim Anderson is the organized chaos loving author behind the Thrifty Little Mom Blog. She helps other people who thrive in organized chaos to stress less, remember more and feel in control of their time, money, and home. Kim is the author of: Live, Save, Spend, Repeat: The Life You Want with the Money You Have. She’s been featured on Time.com, Money.com, Good Housekeeping, Women’s Day, and more!