Quick Start Guide To The Cash Envelope System

You want to know one of my main secrets to paying off our $93,000 mortgage debt in under 2 years? This is it. The Cash Envelope System. This quick start cash envelope system kept my overspending rear in line for two straight years when nothing else had worked in the past.

Every month, I took whatever cash was left in my envelopes, filled out a principle mortgage payment slip and slapped extra money on our mortgage payment. You know what? It felt darn good to feel in control for once.

It felt peaceful and empowering to know EXACTLY where our family’s hard earned money was going every single day!

Maybe you’ve heard of the cash envelope system but have no idea how to get started. This post is a simple quick start guide to the cash envelope system to get you budgeting in a hurry. It’s a cash envelope template.

If you plan to do this with your spouse be sure you read my article: The Cash Envelope Budgeting System for Couples after.

Note that this post is geared toward helping you get started quick. If you’d like to make an actual formulated plan and go deeper be sure you check out my course The Cash Fueled Life (this is a 2-3 hour course that is a very hands-on way for you to dive into creating your own cash-based budget whether your spouse is on board or not).

Why You Need to Try the Cash Envelope System

If you are a person who wants a simple and tangible way to control your spending, envelope systems just work. Why? Because you can only spend the physical cash you have, there is not swiping the card. You either have the money or you don’t. It is one of the simplest forms of budgeting that I know. It takes about 3 months to get into the glow of cash only spending- but I know you can do it and I’m going to quickly show you how.

First Things First: Find the Cash Envelope System Wallet that Works For You:

There are tons of options for how to store/organize your cash. Here is a list of options. Figure out which one works best for you and how much you want to initially invest.

Option 1- A Real Wallet:

- For The Fashion Focused Person: So after sticking with this system for awhile I decided that I wanted a more “discrete” and long lasting real wallet so I invested in a Savvycents Wallet (under $30) from Amazon which has held up great and keeps all my wallet contents together including my cash. I really like that it offers a spot to keep the coin change together on back. This wallet comes in a ton of plain colors and fun patterns.

- I’ve been using it for 6 months and love it! I get tons of complements on this wallet.

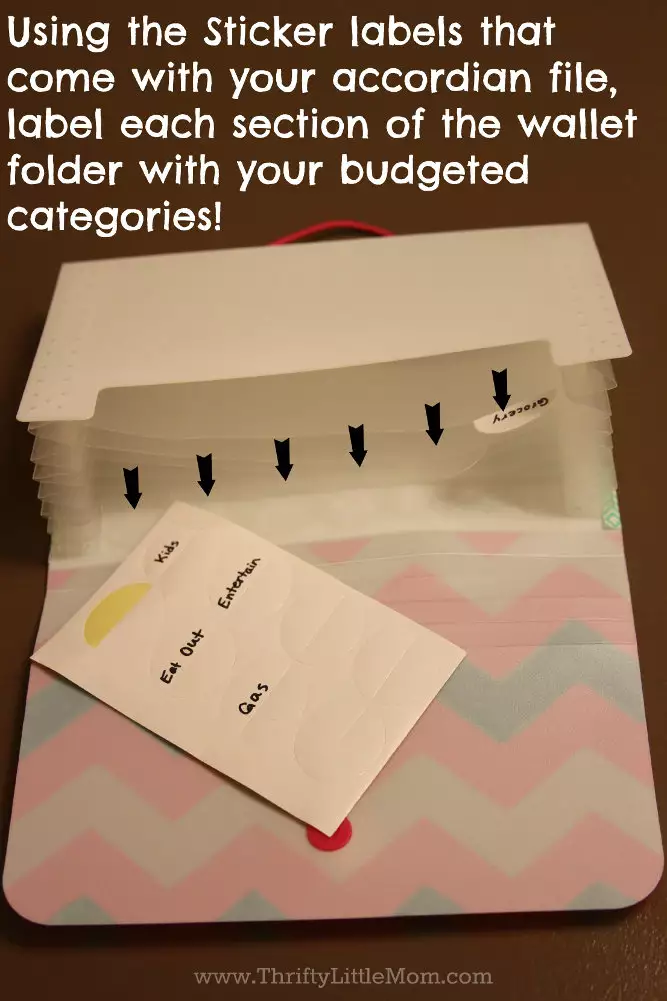

Note: In labeled the image below with these categories to show you how I divide my envelopes up but they come blank so you can personalize them to your own budget needs.

Bella Taylor Navy Solid Cash System Wallet -If you aren’t into funky or bright colors these Bella Taylor wallets look nice and also come in prints that remind me of Vera Bradley style patterns. -Under $50

Deluxe Executive Envelope System: Dave Ramsey’s Financial Peace University – Under $22

This one has a way to track your spending with pen and paper plus the envelope cash holders.

Buxton Women’s Coupon and Receipt Organizer Wallet with Compartment, Plum – Under $10

This wallet comes in several colors including black, red and animal print.

Option 2- A Paper Wallet

Regular Envelopes or something like these pocket size accordion files that I found at Target in the dollar section might be great for starting out. The only flaw is that they don’t really do well with loose change.

SpendVelope Envelope Budget System– These are a paper based envelope that you can divide your money into and each envelope represents a different budget line item. These come with a way to track to your spending on a paper you store inside of the envelope so you can have a visual running balance of what’s going on inside the envelope and how much you’ve spent/how much is left over!

Globe-Weis Poly Zip Envelope, Check, Open Side, Assorted, 5/Pack – These are clear zipper type pouches. These would be nice because they would keep your loose coins together for each category when you spend cash and get change back.

Magnetic Cash Envelopes by Divvy Up, Set of Five. Divide. Spend. Save. Budget Your Way to Savings. (Brilliant Budgeting)– These are a sturdy fabric envelope. They don’t zip up but they do have magnetic openings the stick together, so even though they wouldn’t be great for loose change, they would be quick and easy to use when accessing your cash fast!

Option 3- The Thriftiest Wallet Option

The cheapest option for giving this system a go is grabbing an inexpensive coupon according file folder. These are typically found in the “office” section of your local dollar store or the Target Dollar Stop.

If you want to get crafty and jazz up the pocket size accordion files, check out my post on How To Make Your Own Envelope System Wallet.

2 Pk, BAZIC Assorted 5-Pocket Expanding Files (Coupon/Personal Check Size)– Under $8 for 2.

Step By Step Quick Start Guide To Cash Envelope System

Here’s my Cash Envelope System Setup Video if you are a visual learner:

Step 1: Set up your cash envelope categories.

If you don’t know what your budget categories are- it could be that you don’t have a real budget in place. I recommend that if you are brand new to budgeting that you get The 90 Day Budget Bootcamp which teaches you how to get your family finances organized month by month. When you are ready to start envelopes (meaning you know what spending categories you need them for) you’ll want to label whatever “wallet” you are using with categories. I use labels and pen or permanent marker. The categories are the areas that I overspend on the most. Here are some cash envelope category ideas:

- Groceries

- Allowance

- Dog

- Baby

- Cleaning Supplies

- Restaurant

- Note: Your utilities, gas and other things can obviously be paid using a debit card/check.

Step 2: Go to the bank and divide up your cash.

- Go to the bank and get out your cash budgeted for your categories.Yes, it is a little work but once you figure it out you won’t have to do it again.

- If you have $30 budgeted for gas for the week, you’ll need to make sure you get out a $20 bill and a $10 bill for that envelope.

- So for example (these are just random weekly numbers):

- Groceries- $75

- 3- $20’s 1- $10 1-$5

- Allowance- $25

- 1-$20 1- $5

- Dog- $25

- 1-$20 1- $5

- Baby- $25

- 1-$20 1- $5

- Cleaning Supplies- $10-

- 1- $10

- Restaurants- $5

- 1- $5

- Groceries- $75

- So for example (these are just random weekly numbers):

- When you get to the teller, you’ll need to flip over the withdrawal slip and ask for:

- 6-$20’s, 2- $10’s, 5-$5’s

- Keep these numbers on a little slip of paper in your wallet so you don’t have to remember each time.

- Divide and conquer.

- Split your money up into your plastic coupon book and keep it in your purse like a wallet.

- You only have the money in those divisions to use for those items.

- When the money is out, it’s out!

- You’ll have to do this little thing called “waiting” until your envelopes are filled up the following week.

- If you have $30 budgeted for gas for the week, you’ll need to make sure you get out a $20 bill and a $10 bill for that envelope.

The Payoff:

If you want to dive a little deeper into budgeting check out my other Budgeting posts:

Kim Anderson is the organized chaos loving author behind the Thrifty Little Mom Blog. She helps other people who thrive in organized chaos to stress less, remember more and feel in control of their time, money, and home. Kim is the author of: Live, Save, Spend, Repeat: The Life You Want with the Money You Have. She’s been featured on Time.com, Money.com, Good Housekeeping, Women’s Day, and more!